La pandemia acelera la transformación del sector de entretenimiento en España

Tecnologías como el 5G allanarán el camino para el crecimiento de un sector que crecerá un 3,3% hasta 2024.

La pandemia ha acelerado los cambios en la industria de Entretenimiento y Medios (E&M) en España y en el mundo. La COVID-19 ha impulsado la transformación en la que el sector estaba inmerso y ha potenciado aspectos clave como la digitalización, la personalización o el uso inteligente de los datos, todo ello como consecuencia de los cambios en los hábitos de consumo de los usuarios.

Estas son algunas de las principales conclusiones de la 21ª edición del informe Entertainment and Media Outlook 2020-2024 España, elaborado por PwC. El informe incluye las perspectivas de crecimiento de trece segmentos de la industria en España: Televisión y Vídeo, Vídeo OTT, Publicidad en televisión e Internet, Videojuegos, Realidad Virtual, Radio, Música, Cine, Libros, Revistas, Periódicos y Publicidad Exterior.

Los ingresos globales del sector

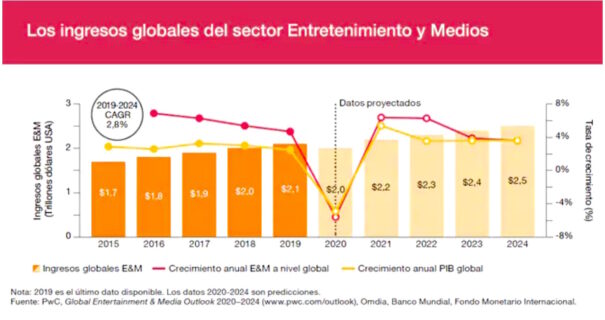

En 2020, el sector de E&M en todo el mundo ha visto cómo su crecimiento se ha frenado y se estima que, a partir de 2021, le seguirá un periodo de recuperación significativa. El documento señala que en España se espera un crecimiento de los ingresos del 3,3% hasta 2024, cuando alcanzará los 32.567 millones de euros. Por encima del crecimiento esperado en todo el mundo, en el mismo periodo, y que se sitúa en el 2,8%, hasta los 2,2 billones de euros.

Impacto desigual de la pandemia

El shock provocado por el coronavirus ha impactado en el conjunto de la industria de manera desigual, ya que mientras que algunos segmentos se han reforzado, otros han acentuado el declive que arrastraban desde hace años. Por ejemplo, la crisis de la COVID-19 ha impulsado el consumo del vídeo bajo demanda en España.

El informe destaca que los ingresos Over The Top (OTT) han crecido un 26% en 2020, respecto al año anterior. Además, se espera que en los próximos cinco años los ingresos por vídeo OTT aumenten un 14,1%, hasta llegar a los 625 millones en 2024.

Concretamente, los ingresos por suscripción a Video bajo Demanda (Subscription Video on Demand (SVOD)) en España aumentarán en el mismo período de tiempo un 15,3%. A nivel global, el informe calcula que este segmento prácticamente doblará los ingresos en 2024.

La televisión de pago en España continúa expandiéndose y, actualmente, más de diez millones de hogares disponen de acceso a alguna de sus modalidades. El documento sostiene que los ingresos por suscripciones de televisión aumentarán un 2,8%, hasta alcanzar los 2.782 millones de euros en 2024.

A pesar de que a lo largo de los últimos años los ingresos procedentes de la publicidad en Internet han cobrado fuerza respecto a la televisión y los medios tradicionales; y de que ha registrado cifras de crecimiento muy positivas, la crisis de la COVID-19 también ha tenido un fuerte impacto en este segmento. El informe estima un incremento en España del 2,2% hasta 2024. A nivel global, este aumento será del 4,7%. Los dispositivos móviles seguirán siendo el principal motor de crecimiento, acaparando el 98% de los nuevos ingresos del periodo 2019-2024.

España es un importante mercado mundial de video games, que está disfrutando de un período de fuerte crecimiento gracias, principalmente, a la espectacular expansión de los juegos sociales en los últimos años, cuyos ingresos superaron a los del juego tradicional, por primera vez en 2016. En 2020, a pesar de la pandemia, se espera que el segmento alcance unos ingresos de 1.823 millones de euros. El mercado mundial de videojuegos, incluyendo los E-Sports, llegarán a los 179.100 millones de euros en 2024, con un crecimiento del 6,5%. Por su parte, el mercado de los eSports en España sigue aumentando a un ritmo superior al del resto de Europa, gracias al interés de los equipos deportivos de alto perfil, de los patrocinadores corporativos y de las audiencias.

He mercado español de podcasts está en auge, con una audiencia mensual de 14,3 millones, frente a los 3,7 millones de 2015. Una tendencia que continuará en los próximos años, ya que el número de oyentes crecerá hasta los 21 millones en 2024. Los ingresos por publicidad de podcasts en España están creciendo incluso más rápidamente que la audiencia, alcanzando los 23 millones de euros en 2019, lo que supone un aumento del 46,8% con respecto al año anterior. A nivel global, en 2019, los ingresos totales del segmento superaron los 1.300 millones de dólares, llegando hasta los 3.600 millones en 2024.

Caída de los segmentos más tradicionales

Los datos de 2020 ponen de manifiesto que los periódicos tradicionales están perdiendo mercado frente a los diarios nativos digitales. El informe apunta a que, en España, los ingresos provenientes de la circulación de periódicos impresos continuarán cayendo a un ritmo del 7%, pasando de los 538 millones de euros de 2019 a los 374 millones de 2024. La caída de los medios impresos se mantiene, pero se ha acentuado como consecuencia de la pandemia.

El mercado español de libros de consumo -el quinto más grande de Europa Occidental-, aumentará sus ingresos hasta los 1.603 millones en 2024, con una tasa de crecimiento del 1,4%. La pandemia ha castigado a este segmento, con un descenso de la venta de libros entre 80% y 90% en el pico de la crisis, según la Federación de Editores Europeos (FEP) y, aunque la venta online de libros ha aumentado, la subida no ha podido compensar la caída general.

También a consecuencia de la pandemia, el mercado de la publicidad en televisión en España -que ya venía experimentando un declive en los últimos años como consecuencia del cambio de hábitos del consumidor-, ha sufrido un fuerte descenso en 2020, llegando al 19%. En 2021 se prevé que la inversión publicitaria televisiva se recupere y aumente un 13%. En España, la Publicidad en televisión está muy concentrada en el formato de televisión convencional y así seguirá siendo en 2024, con un 91% de los ingresos atribuibles a las cadenas en abierto.

En 2019, la industria cinematográfica alcanzó su mejor cifra en toda una década, 624 millones de euros. No obstante, la situación provocada por la pandemia apunta a que los ingresos totales de taquilla bajarán en torno a 250 millones de euros en 2020 y se irán recuperando paulatinamente en los años posteriores, con una caída del 2,8% en el periodo 2019-2024. Un aspecto relevante del sector es la creciente simbiosis entre el cine que se ve en las salas y las plataformas de vídeo en streaming.

Lecciones aprendidas en los últimos meses

La pandemia ha acelerado cambios y tendencias que ya se vislumbraban. Asimismo, el confinamiento ha obligado a los ciudadanos a permanecer recluidos en el hogar, verdadero campo de batalla que las compañías tienen que conquistar para llegar a sus clientes. El informe destaca algunas lecciones aprendidas en los últimos meses:

El estudio observa también ciertos cambios en los patrones de consumo: el consumidor de contenidos ha aprendido con rapidez y es cada vez más exigente, pero dispuesto a pagar por contenidos si son de calidad y responden a sus expectativas.

Las compañías del sector no pueden quedarse paradas: el mercado se ha fragmentado y, como consecuencia, las empresas de E&M están identificando y adaptando modelos de crecimiento innovadores y, sobre todo, que se adapten bien a las nuevas preferencias de un cliente cada vez más dinámico. El refuerzo de las suscripciones en detrimento de la publicidad pone de manifiesto el poder de las conexiones directas con el consumidor como motor de crecimiento.

Por otro lado, tecnología e infraestructuras allanan el camino para el crecimiento: gracias a la velocidad y latencia que aporta el 5G, los usuarios podrán disponer de acceso en tiempo real y con mayor calidad a gran cantidad de contenidos, juegos o servicios. Por su parte, la Inteligencia Artificial estará cada vez más presente en los hogares y en los desplazamientos cotidianos de los usuarios y, aunque estos aprecian cada vez sus ventajas en términos de personalización, persiste cierta preocupación en relación con la privacidad. El informe estima que, en 2025, el 45% del mundo tendrá cobertura 5G y que conectará a más de 1,7 billones de dispositivos.

Patricia Manca, socia responsable de Entretenimiento y Medios en PwC España, destaca que “la pandemia ha acelerado los cambios y las tendencias que se veían venir desde hace años. Hoy, la industria es más digital, las ofertas más personalizadas y los datos se han convertido en la clave para gestionar las demandas de unos usuarios cada vez más exigentes”.

Patricia Manca, socia responsable de Entretenimiento y Medios en PwC España, destaca que “la pandemia ha acelerado los cambios y las tendencias que se veían venir desde hace años. Hoy, la industria es más digital, las ofertas más personalizadas y los datos se han convertido en la clave para gestionar las demandas de unos usuarios cada vez más exigentes”.

Did you like this article?

Subscribe to our NEWSLETTER and you won't miss anything.