La industria española de producción de videojuegos continúa creciendo aunque con extrema atomización

La facturación creció un 15,6%, alcanzando en 2017 los 713 millones de euros. El empleo sumó a 6.337 profesionales en 2017, creciendo un 16,5%.

El sector español de producción de videojuegos facturó 713 millones de euros en 2017, un 15,6 % más que 2016, e incrementó su plantilla en un 16,5%, alcanzando los 6.337 profesionales, según revela el Libro Blanco del desarrollo español de videojuegos en su edición 2018, que ha sido presentado este miércoles en Madrid por la Asociación Española de Empresas Productoras y Desarrolladoras de Videojuegos y Software de Entretenimiento (DEV) con el apoyo del ICEX España Exportación e Inversiones.

La presentación ha contado con la participación en el acto inaugural de Reyes Maroto, ministra de Industria, Comercio y Turismo, y del ministro de Cultura, José Guirao.

El Libro Blanco, que este año cumple su quinta edición, se dirige a los estudios desarrolladores, a los profesionales actuales y futuros, a las entidades públicas y, también, a inversores privados nacionales e internacionales, así como a toda la sociedad en general, siendo una inmejorable herramienta para conocer en profundidad la industria y el mercado del videojuego en España y recabar toda la información posible para la toma de decisiones y la elaboración de planes de inversión y apoyo público de cara a los próximos años.

Perfil empresarial

El censo español de empresas legalmente establecidas y constituidas que se dedican al desarrollo y a la producción de videojuegos asciende a 455.

The 81 % de las empresas activas se creó en los últimos 10 años. Tras un fuerte crecimiento experimentado hace poco más de un lustro, el número de empresas que se dedican al desarrollo y a la producción de videojuegos en España se había redimensionado en 2017 para luego estabilizarse en el siguiente año.

Pese a este estancamiento en el número total de empresas, sigue existiendo un gran potencial de crecimiento, habiéndose censado alrededor de 160 proyectos a la espera de constituirse como entidad legal.

Pese a este estancamiento en el número total de empresas, sigue existiendo un gran potencial de crecimiento, habiéndose censado alrededor de 160 proyectos a la espera de constituirse como entidad legal.

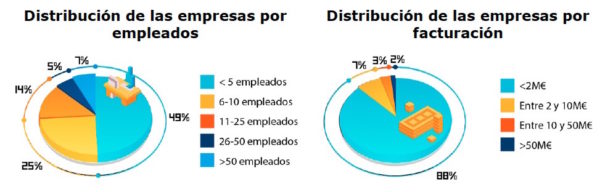

El gran incremento del número de empresas durante la última década no ha ido sin embargo de la mano de una consolidación que haya permitido su crecimiento sostenible. El resultado es un tejido empresarial extremadamente polarizado, compuesto por una amplia base de microempresas. El 88 % de las empresas factura menos de 2 millones de euros y el 74 % emplea a menos de 10 personas.

La mayor parte de las empresas se concentran en cuatro comunidades autónomas: Cataluña, Madrid, Comunidad Valenciana y Andalucía.

La industria productora de videojuegos es altamente exportadora, ya que el 67 % de los ingresos proviene de los mercados internacionales, un 10% más con respecto a 2016. En particular, el peso de los mercados norteamericano y asiático creció en 2017 un 4 % para ambas regiones, lo que es un dato positivo considerando que se trata de los principales mercados mundiales.

Facturación y empleo

El sector productor de videojuegos españoles facturó en 2017 un total de 713 millones de euros, un 15,6% más que 2016. De la misma manera, incrementó su plantilla en 2017 en un 16,5%, alcanzando los 6.337 profesionales.

Según las previsiones, la facturación crecerá a un ritmo anual del 23 % (CAGR 2017-2021), lo que supondría alcanzar en 2021 los 1.630 millones de euros de facturación. De la misma manera, podemos estimar un crecimiento del empleo a una tasa compuesta anual (CAGR 2017-2021) del 18,2 %, hasta llegar a los 12.379 empleos directos en 2021.

Sin embargo, se trata de un crecimiento que se debe en su mayor parte a las empresas de gran tamaño. La mitad de la facturación del sector corresponde a las empresas con facturación superior a los 50 millones de euros. Asimismo, el 59 % del empleo lo conforman aquellas empresas con

una plantilla superior a los 50 empleados.

Por otro lado, las microempresas que facturan menos de 2 millones de euros y emplean a menos de 10 personas suman juntas solamente el 8 % de la facturación y el 7 % del empleo.

Modelos de negocio

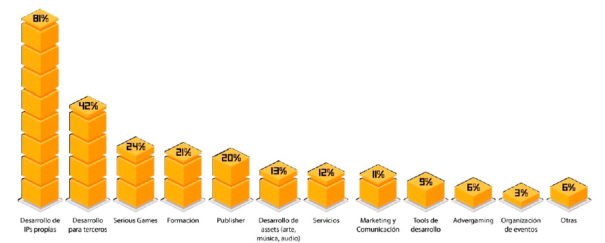

El 81 % de las empresas desarrolla propiedad intelectual propia. Por otro lado, el 42 % desarrolla videojuegos por encargo y el 20 % publica sus juegos o juegos de terceros. El 21 % también lleva a cabo actividades formativas, por su cuenta o en colaboración con centros de formación. Una

de cada cuatro empresas desarrolla serious games.

Los modelos de negocio digitales son los que más facturación generan de media para las empresas españolas de videojuegos: en primer lugar la venta digital, seguida por los modelos de negocio free to play con monetización por publicidad o compras in-game. Los videojuegos por encargo, de media, ya representan un cuarto de los ingresos del sector.

Plataformas y herramientas

Plataformas y herramientas

La plataforma más utilizada por las empresas y estudios españoles sigue siendo el ordenador (PC y Mac), que en los últimos años ha aumentado su presencia. Le siguen los dispositivos móviles (Android por encima de iOS), aunque su uso está decreciendo de forma importante. Por otro lado, las consolas Playstation 4, Nintendo Switch y Xbox One están siendo cada año más utilizadas y podrían llegar a superar a los dispositivos móviles el año que viene. En particular, la consola de Nintendo ha visto duplicar su uso por las empresas españolas en el último año.

Es de destacar que casi todas las plataformas de realidad virtual han visto decrecer su uso con respecto al año anterior. Solamente Oculus Rift y Microsoft Hololens han incrementado su presencia en las producciones de las empresas españolas.

Los grandes retos que presenta la realidad virtual hacen que su implementación en los juegos españoles haya disminuido de forma importante en el último año, junto también, en menor medida, con la Realidad Aumentada. La Realidad Mixta, sin embargo, es el segmento que más está creciendo, impulsada por las expectativas que generan plataformas como Microsoft Hololens y Magic Leap. Por otro lado, la adopción de los modelos basados en eSports se mantiene estable.

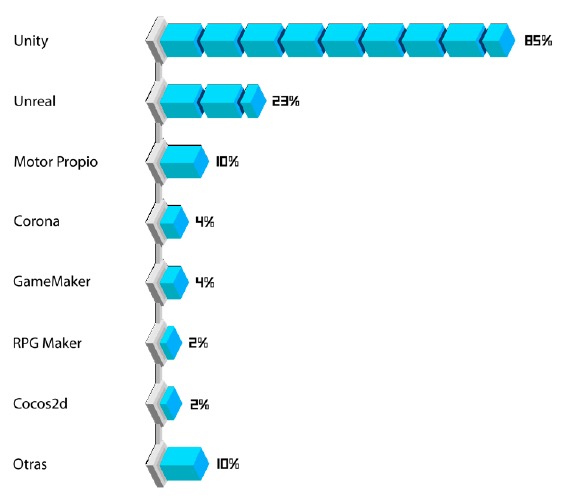

Unity es el motor de juego líder del mercado en España, ya que el 85% de las empresas lo utiliza. Le sigue a mucha distancia Unreal, con un 23%. Destaca el hecho de que una empresa sobre diez utiliza motores propios, lo que pone en evidencia las inversiones en I+D+i del sector.

Acceso al Libro Blanco del desarrollo español de videojuegos.

Did you like this article?

Subscribe to us RSS feed And you will not miss anything.